Yves here. Get a cup of coffee. Below is another meaty discussion with Michael Hudson by Ben Norton, using the US-Israel war with Iran as a point of departure for the role of the Middle East in US hegemony.

As much as there is a great deal of terrific material in this talk, I have to continue to disagree with Hudson on the nature of the US dollar recycling understandings with Saudi Arabia during the oil shock of the 1970s. That framework was set not by Bill Simon of Treasury, but by Henry Kissinger and the State Department in negotiations with the Saudis, importantly its powerful oil minister Saud Al Faisal. Key documents, including detailed notes of important meetings, have been declassified and are on the State Department website. They make clear that the US Treasury was a secondary actor in these arrangements (for instance, they seldom participated in the talks by Kissinger and State with Saud Al Faisal and other top Saudi officials).

And Kissinger and his team framed their concern as how to “recycle” the dollar that the Saudis were piling up. The reason for the effort to persuade the Saudis to concentrate their buying in Treasuries was to forestall them from instead hoovering up US productive assets: interests in public and private companies, commercial real estate, farmland, banks (see Prince Al Waleed’s early 1990s rescue of the critically important Citibank, which plays a critical role as the US financial flagship serving payment needs for US multinationals and smaller exporters). Getting control of productive assets on a large scale would vest tremendous political power with the sheikdom.

I reject the thesis that the Saudis had much in the way of alternatives in the 1970s to reinvesting their dollars much of anywhere beyond the US (they did, as I have recounted, impressively bid up prime real estate in London, buying huge swathes of tony Mayfair). The US was the dominant global economy and even with the oil shock, had strong growth prospects. The US financial markets were the deepest, the most liquid, and the best regulated. US disclosures and investor protections like prohibitions against front-running and bid-rigging exceeded those of any other market at the time. There was no Euro back then, so the alternative would have been to invest in much smaller national markets like the UK or Germany, which has much less in the way of easily traded investments. As of 1984, when I was on a study for the world’s biggest foreign exchange trading desk, Citibank in London, the big currency “crosses” were against the dollar.

The US as the standout player in providing a safe regime for investors continued until easily the early 1990s, see Amar Bhide (who is regularly a contrary thinker and no naif; among other things, he ones ran a proprietary trading operation) in the Harvard Business Review in 1994 for confirmation.

The development of exchange-based markets for oil futures, starting in 1983 helped further cement the role of the dollar in the oil trade (keep in mind commodities traders like Philips Brothers, which acquired Salomon Brother but was then subject to a reverse takeover had been arranging private hedges before then).

Even though the 1970s negotiations with the Saudis did secure their agreement to keep their dollar holdings significantly in Treasuries, the continued role of the dollar as reserve currency depends on the US running sustained trade deficits, and not the oil trade. The big disproof of the petrodollar thesis is the very aggressive accumulation of large foreign exchange balances by China and Southeast Asian countries in the wake of the 1997 Asian crisis. These countries ex China had been subjected to the tender ministrations of the IMF and did not want that to happen again. So their manipulated their currencies to be comparatively cheap against the dollar so as to run sustained trade surpluses and accumulate a rainy day dollar assets hoard. That would enable them to intervene in a big way if they were ever again at risk of a currency crisis. This course of action clearly had nothing to do with the oil trade. Ditto Japan’s accumulation of large Treasury holdings during its 1980s period of manufacturing dominance and large trade surpluses with the US.

Originally published by Ben Norton at Geopolitical Economy Watch

You can read Michael Hudson’s underlying article here: War on Iran is fight for US unipolar control of world.

Introduction

BEN NORTON: Why is the United States so concerned about Iran?

US President Donald Trump admitted that what Washington wants is regime change in Tehran, to overthrow the Iranian government.

Trump backed a war on Iran in June, in which both the US and Israel directly bombed Iranian territory.

Trump claimed that he brokered a ceasefire after what he calls the 12 Day War that the US and Israel waged against Iran. But it’s very difficult to believe that this ceasefire will hold.

Especially considering that Trump said the same in January. He claimed to broker a ceasefire in Gaza, but then in March, two months later, Israel started the war again, after Trump had given Israel the green light to violate the ceasefire that he helped to broker.

So it’s very difficult for Iranian officials to believe that the ceasefire will truly hold. And even if it does hold in the short term, the reality is that the US government has been waging a kind of political war and an economic war against Iran for many decades, going back to 1953, when the US carried out a coup that overthrew Iran’s democratically elected Prime Minister Mohammad Mosaddegh and installed a pro-US dictator, Shah Mohammad Reza Pahlavi.

So why is this? What does Washington want to get out of its never-ending political and economic war on Iran?

To try to answer this question, I interviewed the renowned economist Michael Hudson, who has written many books and is an expert on global political economy.

Michael Hudson published an article in which he outlines the economic and political reasons for this war on Iran, and he posits that this is part of the attempt by the US empire to impose a unipolar order on the world, like we saw in the 1990s, when the US was the only superpower and it could impose its political and economic will on almost all countries on Earth.

Iran was one of the very few countries that was actually resisting US unipolar hegemony. And today we see, as the world is more and more multipolar, Iran plays an important role as a BRICS member, and as a supporter of resistance groups.

Iran is pushing for a more multipolar world, in opposition to the US empire’s unipolarity, as the economist Michael Hudson describes in this essay.

Hudson wrote:

What is at stake is the US attempt to control the Middle East and its oil as a buttress of US economic power, and to prevent other countries from moving to create their own autonomy from the US-centered neoliberal order administered by the IMF, World Bank, and other institutions to reinforce US unipolar power.

In our discussion today, Michael connects all of the different factors involved in this conflict, including the oil and gas and other resources in West Asia (in the so-called Middle East); including the role of the US dollar and the petrodollar system; and how Iran, as a member of BRICS, and many other Global South countries, are de-dollarizing and seeking alternatives to the dollar.

We also talk about the geopolitics of the region, the trade routes and interconnectivity among China, Iran, and Russia, as part of a project of Eurasian integration; we talk about the geopolitical goals of the US and Israel; and much, much more.

Here is an excerpt of our conversation, and then we’ll go straight to the interview:

MICHAEL HUDSON: What we have seen in the last month — or I should say the last two years actually — is the culmination of the long strategy that America has had ever since World War II, to take complete control of the Near Eastern oil lands and make them proxies of the United States, under client rulers, such as Saudi Arabia and the king of Jordan.

Iran represents a military threat to Russia’s southern border, because if the United States could put a client regime in Iran, or break up Iran into ethnic groups who would be able to interfere with Russia’s corridor of trade southwards, into access to the Indian Ocean, well, then you have boxed in Russia, you have boxed in China, and you have managed to isolate them.

That is the current American foreign policy. If you can isolate countries that do not want to be part of the American international financial and trade system, then the belief is that they cannot exist by themselves; they are too small.

America is still living back in the epoch of the 1955 Bandung Conference of Non-Aligned nations in Indonesia. When other countries wanted to go alone, they were too economically small.

But today, for the first time in modern history, you have the option of Eurasia, of Russia, China, Iran, and all of the neighboring countries in between. For the first time, they are large enough that they do not need trade and investment with the United States.

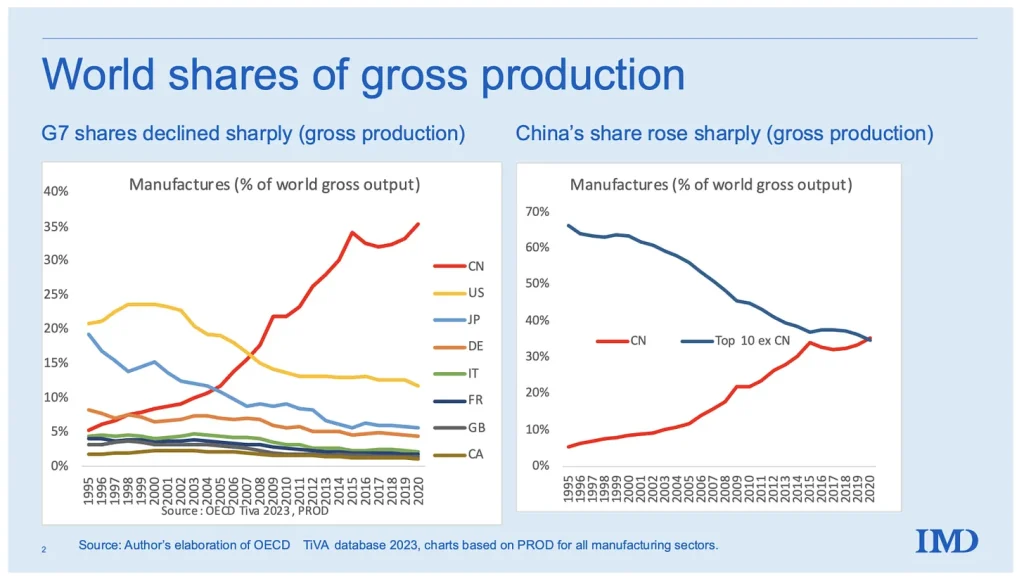

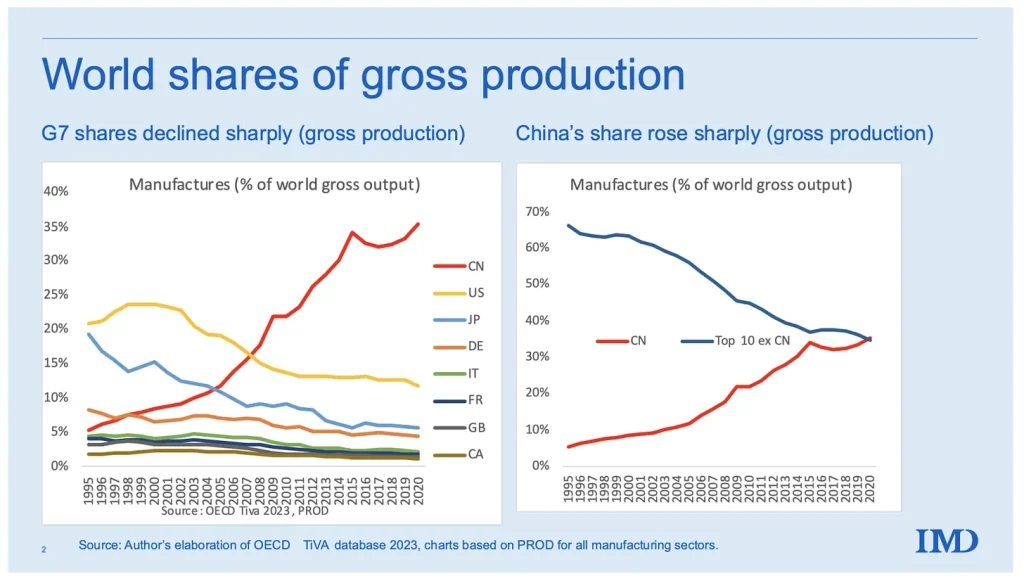

In fact, while the United States and its NATO allies in Europe are shrinking — they are de-industrialized, neoliberal, post-industrial economies — most of the growth in world production, manufacturing, and trade has occurred in China, along with the control of the raw materials refining, such as rare earths, but also cobalt, even aluminum, and many other materials in China.

So America’s strategic attempt to isolate Russia, China, and any of their allies in BRICS or the Shanghai Cooperation Organization ends up isolating itself. It is forcing other countries to make a choice.

That is the only thing that America has to offer other countries in today’s world. It can’t offer them exports. It can’t offer them monetary stability.

The only thing that America has to offer the world is to refrain from destroying their economy and causing economic chaos, such as Trump has threatened to do with his tariffs, and what he has threatened to do to any country trying to create an alternative to the dollar.

Hence this free lunch, where other countries can earn dollars, but they have to re-lend them to the United States. And the United States, as their banker, has to hold it all, and the banker may just decide whom to pay and whom not to pay.

It’s a gangster. It has been called a gangster state, for just such reasons. And other countries are afraid of what the United States can do, not only under Donald Trump, but what it has been doing for the last 50 years. It is simply confiscating, and destabilizing, and overthrowing.

America has basically declared war against any attempt to create an international trade and investment system that the United States does not control, in its own self-interest, wanting all of the earnings from it, all of the revenue from it, not just part of it. It’s a greedy empire.

Interview

BEN NORTON: Michael, thanks for joining me. It’s always a real pleasure having you.

Let’s talk about this article you wrote, in which you argue that the war on Iran is part of an attempt by the United States to impose its unipolar hegemony on the world.

We see that we’re living in more and more of a multipolar world, and Iran has played an important part of the multipolar project as a member of BRICS, as a member of the Shanghai Cooperation Organization, as a partner of China and Russia. Iran has also been pushing for de-dollarization of the global financial system.

Talk about how you see the war on Iran — which didn’t start under Donald Trump, this goes back many years — and how you see it in particular as an economist.

MICHAEL HUDSON: Well, the war on Iran started in 1953, when the United States and MI6 overthrew the elected Prime Minister [Mohammad Mosaddegh], and the reason he was overthrown was because he wanted to nationalize the oil reserves of Iran. The United States has always viewed Iran as part of the Near Eastern oil Gulf.

American foreign policy, in terms of weaponizing its foreign trade, has always been based on two commodities: food grains — the ability to stop exporting food to countries that oppose US policy, as the United States stopped exporting grain to China under Mao — and oil.

For a century, the United States has focused on control of the oil as the basis of its international trade balance — it’s the largest contributor to the trade balance — and of its ability to sanction the rest of the world, by turning off the oil supply, and thereby turning off the electricity, turning off the gas, turning off the home heating, of countries that break away from US policy.

When I worked for the Hudson Institute in the early 1970s, Herman Kahn brought me to a meeting with some generals, and they were discussing what to do with Iran in case, under the shah, Iran should ever once again try to assert its autonomy and go its own way.

Iran has always been the strongest power in the entire Near East, and the capstone to controlling the Near East. You cannot fully control the Near Eastern oil — Syria, Iraq, the rest of the countries there — without controlling Iran too, because of the size of its population and the strength of its economy.

It was a very interesting meeting. Herman Kahn, the model for Dr. Strangelove, discussed how to break up Iran into its various ethnicities, five or six ethnicities, in the case that it should, take a policy independent from the United States.

The United States’ concern already in the 1970s, 50 years ago, was, “What do we do if other countries do not follow the kind of international world order that we are, organizing?”

Herman said that he thought the crisis point that was going to break up in international news was going to be Balochistan, at Iran’s border with Pakistan. The Balochis are a distinct population, just as the Azerbaijanis, Azeris, the Kurds.

Iran is a composite of many ethnic groups, including a very large Jewish group there. It is a multi-ethnic society, and the United States’ strategy, in case there was a war against Iran, was to play on these ethnicities — just as similar plans were drawn up for Russia, how to break it into separate ethnic parts; and China, how to break China into ethnic parts, at such point as America wants to take them on.

And the reason this ethnic division was developed was, as a democracy, especially in the 1970s, it became very apparent that the United States never again could field an army for invasion, as it was doing in Vietnam.

At the time I sat in on this meeting, late 1974 I think, or early ’75, there were demonstrations. It was obvious that there could never be a military draft again.

How was the United States to exert its international power without military power? It had military bases all over the world; it spent more on military than any other country.

The entire US balance of payments deficit was military spending abroad, and yet it couldn’t go to war. It had to use proxies.

This was the time when, in addition to the discussions that I sat in on how to use ethnicities in countries that we declared war on, as opponents; America decided to create the largest military base in the Near East, and that was Israel.

Henry Jackson, the pro-war, Military-Industrial Complex’s senator, met with Herman Kahn — I actually was in Herman’s office, listening to the phone call, when it came through — and the agreement was that the Military-Industrial Complex and Jackson would back Israel, if Israel agreed to act as America’s landed aircraft carrier in the Near East, as it was put at the time.

Herman very gladly made that arrangement, because the Hudson Institute at that time was a Zionist organization, and it was a training ground for Mossad.

One of my colleagues was Uzi Arad. We made a number of trips together to Asia. And Uzi became Netanyahu’s advisor and head of Mossad in subsequent years.

So I sort of sat in at the time when the American strategy was being outlined.

Israel was going to be America’s face, and indeed has been coordinating America’s backing of Al-Qaeda and the Wahhabi butchers who have taken over Syria, and are now busy killing the Christians, killing the Shiites, killing the Alawites.

And you will never see any criticism of Israel by Al-Qaeda, or the group [Hayat Tahrir al-Sham (HTS)] in Syria, whatever you want to call it there now. And vice versa, there has always been a working relationship.

So this gives some background as to how long the United States has anticipated the day when it would try to finally capstone its invasion of Iraq, its attack on Syria, its destruction of Libya, its backing of the destruction of Lebanon, and other countries, in North Africa, etc.

What we have seen in the last month — or I should say the last two years actually — is the culmination of the long strategy that America has had ever since World War II, to take complete control of the Near Eastern oil lands and make them proxies of the United States, under client rulers, such as Saudi Arabia and the king of Jordan.

Geopolitics and Global Trade

BEN NORTON: You raised so many interesting points, Michael. I want focus on two main issues here: one is the geopolitics of Iran’s integration with Eurasia, and the other is oil and the petrodollar system.

I will start with the geopolitics. Of course, when we talk about the petrodollar, we should keep in mind that Iran has been selling its oil and gas in other currencies, and pushing for de-dollarization.

But before we get to that, I want to talk about the role that Iran has played not only in supporting resistance groups in West Asia, but also in deepening its political and economic partnership with China and Russia, as part of a larger Eurasian partnership.

There are numerous physical projects integrating these regions.

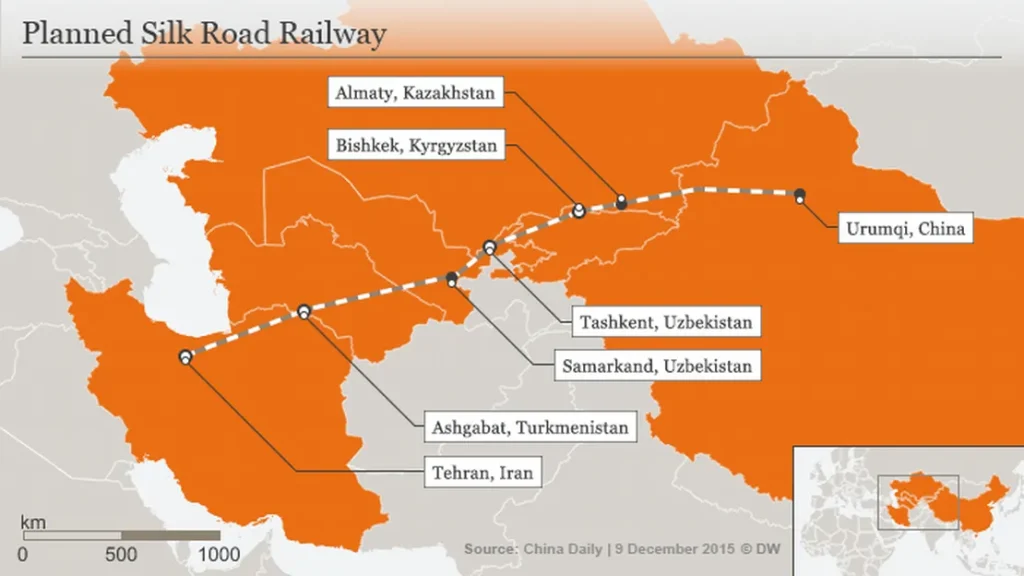

Iran is at the heart of China’s New Silk Road. This was originally launched by Chinese President Xi Jinping in 2013, and then it expanded into the Belt and Road Initiative (BRI).

Iran is an important part in that, connecting East Asia, through Central Asia, through Iran, into West Asia. And the US has really tried to disrupt that.

Iran also plays an important role in a Russian-led economic corridor that connects from St. Petersburg, through Moscow, down through the Caspian Sea, through Iran, and to India.

This is known as the International North-South Transport Corridor, the INSTC.

So we have seen that Iran has played a very important role challenging the US dollar, challenging US hegemony, and also seeking economic and political integration with other countries in Eurasia.

Can you speak more about this and why these imperial planners in Washington see this as so much of a threat?

MICHAEL HUDSON: Well, you just summarized the two maps that I included in my article.

About a month ago, Iran just completed its Belt and Road railroad, that goes all the way to Tehran. For the first time, there is a land corridor from Iran to China.

Now, the Belt and Road corridor means they’re avoiding going by sea.

American and British military policy has been based for a hundred years on control of the seas, and control of the oil trade was part of that strategy.

Because if Iran, Saudi Arabia, Kuwait, and the other oil-producing countries can’t load up tankers with oil, how are they going to be able to export? And how can importers such as China, or India, obtain oil from the Near East?

Well, with China’s Belt and Road Initiative, its intention was to go all the way through, via Iran, and then proceed on all the way to the Atlantic Ocean, to Europe.

This Belt and Road was to span the entire Eurasian continent, the entire eastern hemisphere.

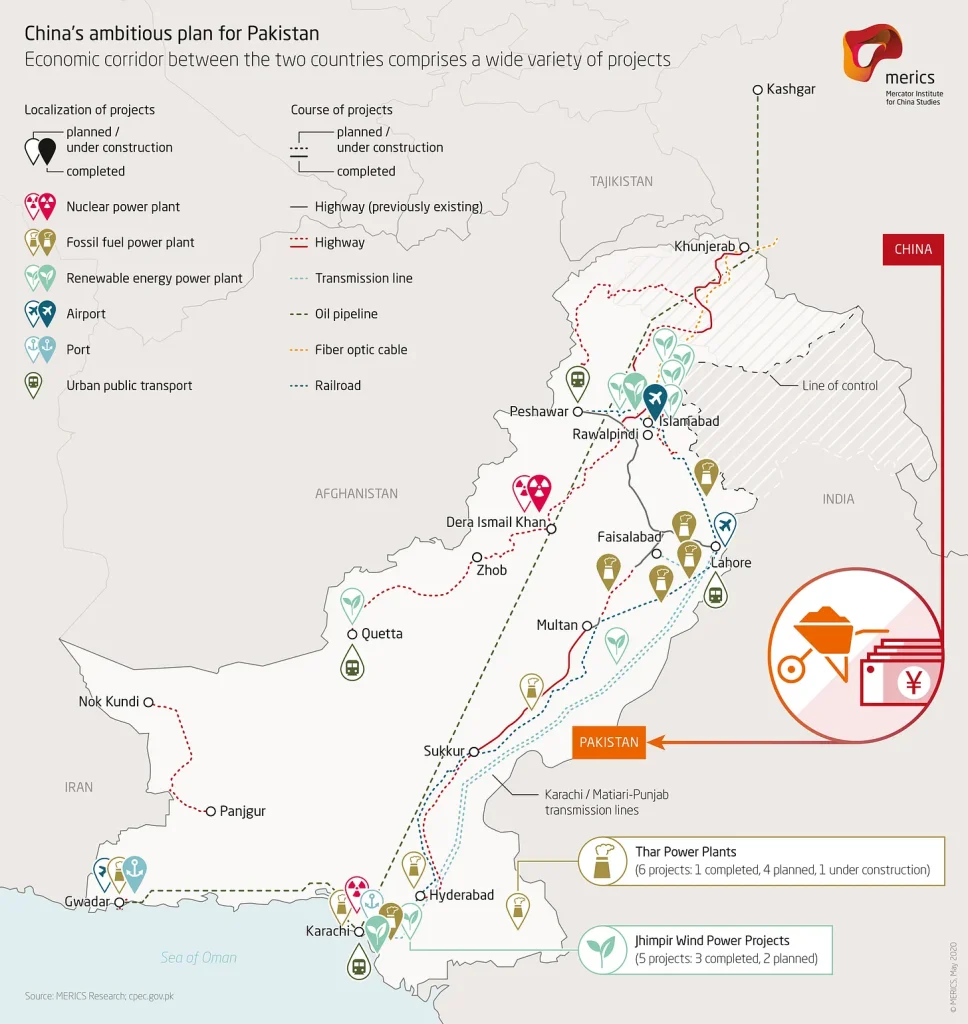

And if the United States could conquer Iran and take it over, that would interfere with China’s long-distance railroad development, and it would block it — just as the United States is hoping to goad India and Pakistan into some kind of fight that would interrupt China’s Belt and Road Initiative that goes through through Pakistan [the China-Pakistan Economic Corridor (CPEC)].

So, on the one hand, Iran is the key to China’s overland trantransportation to Europe.

And as you just pointed out, with Russia: Iran represents a military threat to Russia’s southern border, because if the United States could put a client regime in Iran, or break up Iran into ethnic groups who would be able to interfere with Russia’s corridor of trade southwards, into access to the Indian Ocean, well, then you have boxed in Russia, you have boxed in China, and you have managed to isolate them.

That is the current American foreign policy. If you can isolate countries that do not want to be part of the American international financial and trade system, then the belief is that they cannot exist by themselves; they are too small.

America is still living back in the epoch of the 1955 Bandung Conference, of Non-Aligned nations, in Indonesia. When other countries wanted to go alone, they were too economically small.

But today, for the first time in modern history, you have the option of Eurasia, of Russia, China, Iran, and all of the neighboring countries in between. For the first time, they are large enough that they do not need trade and investment with the United States.

In fact, while the United States and its NATO allies in Europe are shrinking — they are de-industrialized, neoliberal, post-industrial economies — most of the growth in world production, manufacturing, and trade has occurred in China, along with the control of the raw materials refining, such as rare earths, but also cobalt, even aluminum, and many other materials in China.

So America’s strategic attempt to isolate Russia, China, and any of their allies in BRICS or the Shanghai Cooperation Organization ends up isolating itself. It is forcing other countries to make a choice.

This was made very clear immediately upon Trump taking the presidency and announcing his tariff policy, saying, “In three months, I’m going to impose such devastatingly high tariffs that you, the Global South countries, the Global Majority countries, your economies will be in chaos without having access to the American market”.

But, [Trump said], “We have three months to negotiate, and, if you give us a give-back, I will roll back these tariffs to 10%, so that it won’t devastate your economies. And one of the agreements that you have to make is you’ll agree to America’s sanctions not to trade with China, not to invest in China, not to use alternatives to the US dollar”.

China is trying to avoid using dollars, just as Russia no longer is able to use dollars, because the United States has simply confiscated $300 billion of Russia’s foreign exchange holdings in the West, that it held in Brussels, in order to manage its foreign exchange, to stabilize its exchange rate, which is what central banks do throughout the world.

Well, it’s very interesting. The Financial Times had a front page article [reporting] that now European countries, especially Germany and Italy, which have the second- and third-largest gold holdings, have asked, “Could you please [give us our gold back]? We have, since World War II, we have left all of our gold supplies at the Federal Reserve in New York”.

America’s gold is in Fort Knox, but other countries keep their gold reserves in the basement of the Federal Reserve Bank, right across from Chase Manhattan bank in the downtown area.

And other countries now realize that, under Trump, if he says, “Well, Europe has been really taking advantage of us; they have been exporting more to us than we’ve sold to them” — you know, Italy and Germany are worried that somehow America will say, “Well, we’re just gonna grab all of this gold that you’ve built up by taking advantage of us”.

So you’re having the rest of the world pull back from the dollar. This reflects the effect of everything that the United States is trying to do to isolate the other parts of the world from contact with the United States, if they try to have an alternative economic system to neoliberal finance capitalism, if they try to have industrial socialism — which is really industrial capitalism on the way to being industrial socialism, with active government investment in basic infrastructure, instead of privatizing the infrastructure Margaret Thatcher style.

The effect will be to leave the United States isolated, and all the rest of the world going its own way, unable to trade with the United States because of the high tariffs that Trump has imposed, and afraid to trade in dollars because of the predatory weaponization of the dollar standard, which had been America’s free lunch under the whole epoch of US Treasury bill standard, since America went off gold in 1971.

Oil and the Dollar

BEN NORTON: Again, Michael, you raised so many good points there.

I want to stick with this issue of oil and the US dollar, and the petrodollar system.

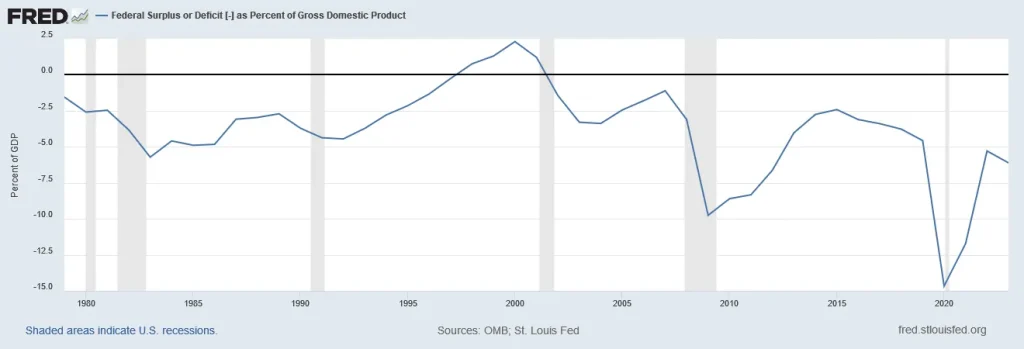

Now, you have mentioned a few times that the US really relies on exports of oil and control of the oil trade, partially to try to reduce its enormous current account deficit — which, I mean, it still is not very successful. The US runs massive current account deficits — that is, trade deficits with the rest of the world.

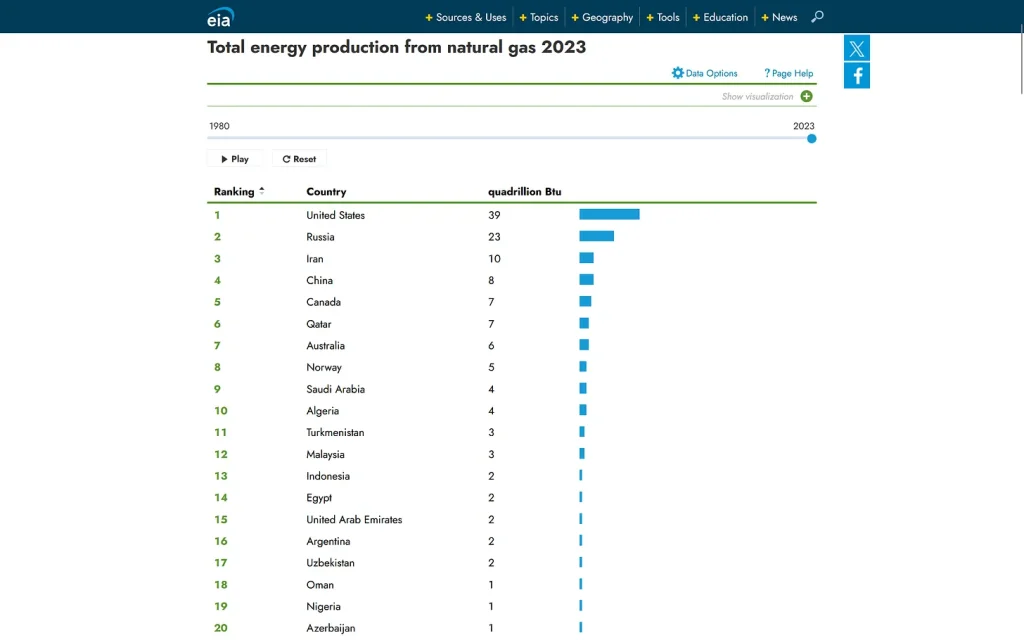

But what is something that is different in the 2020s is that the US is now the world’s largest exporter of oil. It’s the largest producer of oil on Earth, and the largest producer of gas.

So that’s a significant difference. That’s largely a development in the past decade due to the explosion in fracking in the US, and also the shale oil revolution.

So, it’s not necessarily that the US needs to physically get access to all of the oil in the region.

Although, of course, US fossil fuel corporations would love to privatize all of the oil in West Asia, that is state-owned.

So for instance, we talked about Mohammad Mosaddegh, the prime minister of Iran who was overthrown in the 1953 CIA-backed coup, after he nationalized the oil in Iran and kicked out US and British oil companies.

Well, the current Iranian government, following the Iranian Revolution in 1979, also nationalized the oil, and the Iranian state does actually have a lot of influence in the economy, including through state-owned enterprises.

So, of course the US would love to privatize that. But this is not really necessarily about getting access to all that oil.

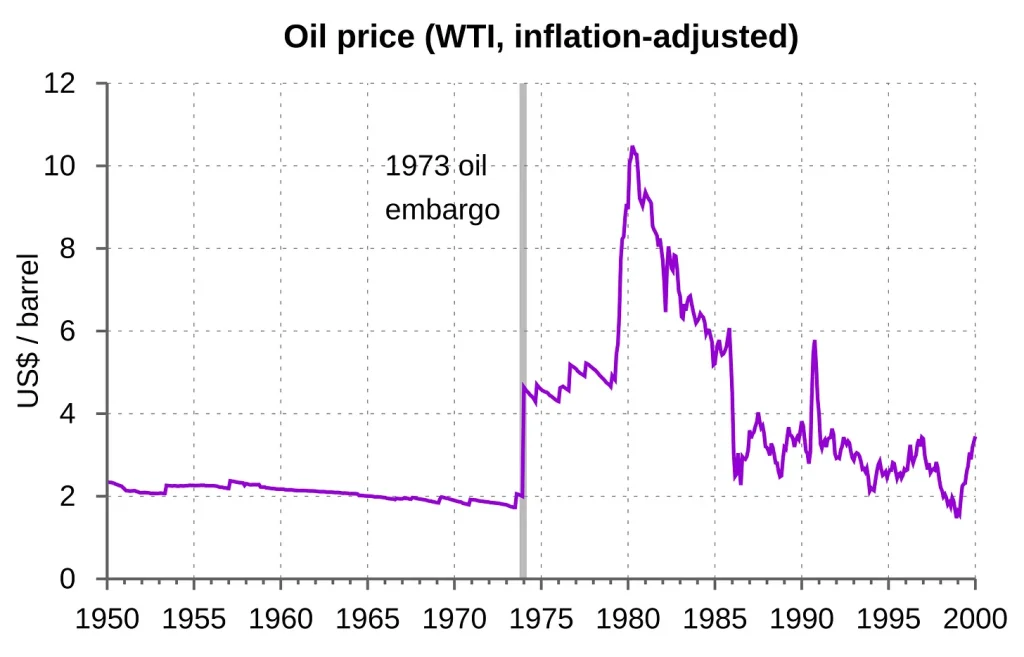

This is about maintaining the current financial order, which is really backed by oil, especially after Richard Nixon in 1971 took the dollar off of gold.

Then, in 1974, Nixon sent his treasury secretary, William Simon — Bill Simon, from Salomon Brothers — who was a bond expert. He ran the Treasuries desk, trading US government debt at Salomon Brothers, this major Wall Street investment bank.

He was sent to Jeddah in 1974, where they brokered a deal saying that the US would protect the Saudi monarchy, and, in return, Saudi Arabia would sell all of its oil in dollars, maintaining global demand for the US dollar.

This came one year after the OPEC oil embargo, in which the countries in the Global South showed that they could use their control of oil as a geopolitical tool to punish the US and the West for their support of Israel.

So I mean, all this history is still so relevant today.

Now, Iran is directly challenging that petrodollar system. Iran is selling its oil to China in Chinese yuan, the renminbi.

Iran is also trading with India, selling its oil, and it is using its currency, the rial. India is also using its currency, the rupee, and India is essentially trading its agricultural goods for Iranian oil.

So can you talk about this petrodollar system, and why Iran is seen as such a major challenge to this system? And really what that means is a direct challenge to the global dominance of the US dollar itself.

MICHAEL HUDSON: Well, I mentioned that the original drive of the United States was to control Near Eastern oil.

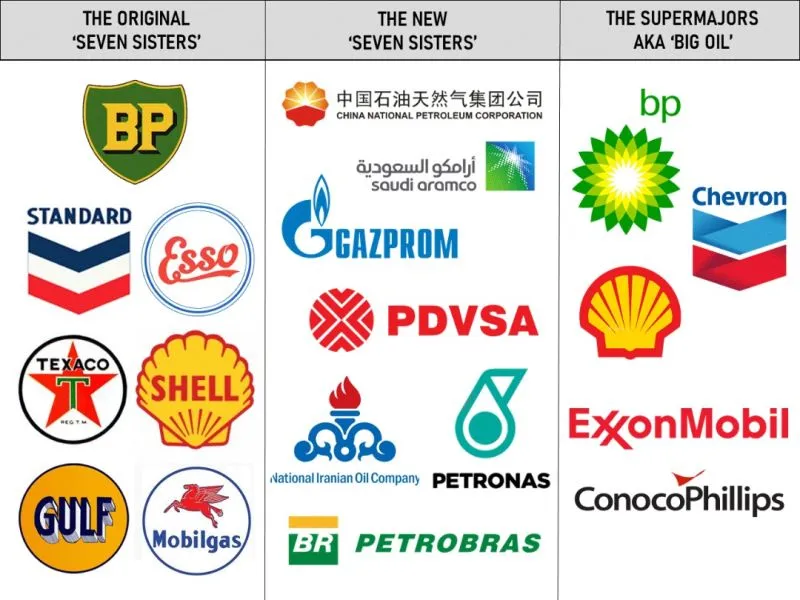

I was the balance of payments economist for Chase Manhattan Bank, and I did a whole study on behalf of the US oil industry to calculate the balance of payments returns, and the average dollar spent by the Seven Sisters, the big oil companies.

The average dollar invested in Saudi Arabia, Kuwait, other Arab countries, was recovered in only 18 months.

Oil was the most profitable investment in the entire US economy, and it was tax free.

Now, the original plan, as I mentioned, of the US in the Near East, it viewed as having oil. Then came the oil war — and it was more than an oil war — in 1974, after Israel waged the 1973 war, and after the United States quadrupled its grain prices.

Well, you mentioned [Nixon’s Treasury Secretary] Bill Simon. Herman Kahn and I went to meet with Bill Simon in 1974, to discuss what should America’s strategy be with the oil companies.

Simon said, “We’ve explained to them that, they can charge whatever they want for oil. They can quadruple the prices”.

In fact, that made Standard Oil of New Jersey, Socony [later Mobil], and the other American oil companies very happy, because, as you point out, America was itself a huge oil producer.

When the OPEC countries quadrupled the price of oil, that made the American oil companies immensely profitable on their and Canada’s oil production.

So, Bill Simon told me that he had explained to them that they could charge whatever they wanted for the oil; quadrupling was okay.

But the agreement was they had to keep all of their savings from what they made off this oil — I won’t call it profit, because it’s really natural resource rent — they had to keep their rents in the United States economy.

The deal was that Saudi Arabia and other countries would export their oil for dollars; they would not remove these dollars from the United States.

They would leave the dollars that they were paid by European countries, by other countries buying their oil; they would invest it primarily in US Treasury securities, and they could also buy US stocks and bonds.

But they could not do what America did with its foreign exchange of European currency, for instance. The OPEC countries could not buy control of any major American company.

They could buy stocks and bonds, but they had to spread the investment in the stock market over the market as a whole. So I think the king of Saudi Arabia bought a billion dollars of every stock in the Dow Jones Industrial Average, to spread it all out.

But most of their money was kept safely in US Treasury securities.

So, essentially, the OPEC revenue — I won’t say earnings because, again, it wasn’t really earned; it’s unearned income — OPEC revenue from the oil sales all ended up in the United States, most of it lent to the United States government.

Well, that inflow of dollars is what enabled the United States to do two things.

One, as a balance of payments inflow, it enabled the United States to continue spending its military overseas spending abroad, in order to have the military fist behind its economic empire.

But it also funded the domestic budget deficit. Foreign central banks were largely funding America’s own domestic budget deficit, by their holding of American Treasury bills.

So the OPEC countries essentially became captive parts of the American financial system that I had described in my book Super Imperialism.

So I met with the Treasury Treasury people, basically explaining what I had written about in Super Imperialism, about how ending other countries’ practice of holding their international monetary reserves in gold, but holding them in loans to the US Treasury in the form of buying Treasury bonds as the vehicle for their savings, essentially made the savings of the entire world, the monetary savings, all centralized in Washington and New York.

That control of what began as control of the oil trade, to weaponize the trade in oil, became control of the international financial system with the dollar’s surpluses being thrown off by the oil trade.

So you had that symbiosis between the trade system and the financial system as the basis for American military policy, and what I called super imperialism.

Super Imperialism

BEN NORTON: Yeah, and what you described over 50 years ago, so brilliantly, as the system of super imperialism, what we’re seeing today is that Iran and other BRICS countries are challenging that system.

They are challenging the exorbitant privilege of the US dollar and trying to seek alternatives.

So maybe you can speak more about this global de-dollarization movement and how Iran plays a central role in this.

And that is one of the reasons, of course, why it’s a target of the US.

MICHAEL HUDSON: Well, Iran really wasn’t central to it, because the United States has been able to isolate Iran.

As soon as the shah was overthrown, the United States played a dirty trick on Iran — Chase Manhattan Bank did.

Iran had a foreign debt — like every country has, by issuing foreign bonds — and it sent the dollars to the Chase Manhattan Bank, to pay the bond holders their dividends.

The Treasury went to David Rockefeller and told him, “Don’t send this Iranian money along. Just hold it there”. And so Iran was considered to be in default, and the entire foreign debt came due, and America seized, confiscated, Iranian economic and financial resources in the United States.

They later negotiated to give it back, because all of this was illegal under international law, but that has never stopped the United States, as we’re seeing right now.

After the shah was overthrown, the United States said, “We’ve got to destabilize the the new Iranian government, and if we grab its foreign reserves, that will cripple it and cause chaos, and that’s how we run the world, by causing chaos”.

That is the only thing that America has to offer other countries in today’s world. It can’t offer them exports. It can’t offer them monetary stability.

The only thing that America has to offer the world is to refrain from destroying their economy and causing economic chaos, such as Trump has threatened to do with his tariffs, and what he has threatened to do to any country trying to create an alternative to the dollar.

Hence this free lunch, where other countries can earn dollars, but they have to re-lend them to the United States. And the United States, as their banker, has to hold it all, and the banker may just decide whom to pay and whom not to pay.

It’s a gangster. It has been called a gangster state, for just such reasons. And other countries are afraid of what the United States can do, not only under Donald Trump, but what it has been doing for the last 50 years. It is simply confiscating, and destabilizing, and overthrowing.

America has basically declared war against any attempt to create an international trade and investment system that the United States does not control, in its own self-interest, wanting all of the earnings from it, all of the revenue from it, not just part of it. It’s a greedy empire.

Sanctions and Economic Warfare

BEN NORTON: Yeah, and what you’re getting at, Michael, is such an important point, because essentially what this shows is that these tactics that the US has abused more and more frequently in the past few decades are not entirely new.

Today, one-third of all countries on Earth are under US sanctions, which are unilateral; they are illegal under international law.

But of course, Iran was one of the first countries to be sanctioned, after its revolution in 1979.

And we know that in 2022, the US and the EU seized $300 billion dollars and euros worth of Russian assets, and that was a huge wake-up call to the world.

But, actually, Iran was the kind of first test case. It was the US that seized Iran’s assets first, and then they later seized Venezuela’s assets, and then Afghanistan’s assets, and now Russia.

So Iran was always the first country to be targeted by these aggressive tactics, and now they have become so commonplace that we have seen a kind of global rebellion against this system, even by longtime US allies.

Like for instance Saudi Arabia and the UAE, which historically have been US client states, but they see what has happened to Russia, Iran, and Venezuela, and they’re worried that they could be next.

MICHAEL HUDSON: Well, this is exactly what is shaping Saudi Arabian and Arab policy in the region.

Obviously, the Arabs don’t like what Israel is doing in Gaza.They don’t like the ethnic cleansing, and the ethnic cleansing of the West Bank, and the whole attack on the Palestinians and other Arab populations.

But they’re afraid of acting on behalf of Iran.They may be very sympathetic with it. The populations of these countries are very much against the violence that Israel is waging against the Arab states, but the leaders of these countries have a problem: All of the savings that Saudi Arabia has accumulated for the last 50 years are held as hostage in the US Treasury and in the US banks.

And the US banks, essentially, are arms of the Treasury. Most of all, Chase Manhattan was a designated bank that would act on behalf of the Treasury. Citibank was more independent, of that.

So you have not heard a peep out of Saudi Arabia and its neighboring oil-producing countries, because they’re afraid. They realize that they’re in a very delicate position.

All of this money that their sovereign wealth fund that they have built up to finance their own future development — if you can call what they’re doing, it’s a twisted development — but their plans for the future are held hostage, and they’ve been politically neutralized, because of this exposure to the US dollar.

Well, you can imagine that other countries realize what is happening, and Asian countries, the Global South countries, and even European countries like Germany and Italy, say, “We don’t want to be stuck in the same trap that the Arab countries are stuck in, where not only our savings, and Treasury securities, and US stocks and bonds, and our investments in the United States are held hostage; our gold supply is being held there!”

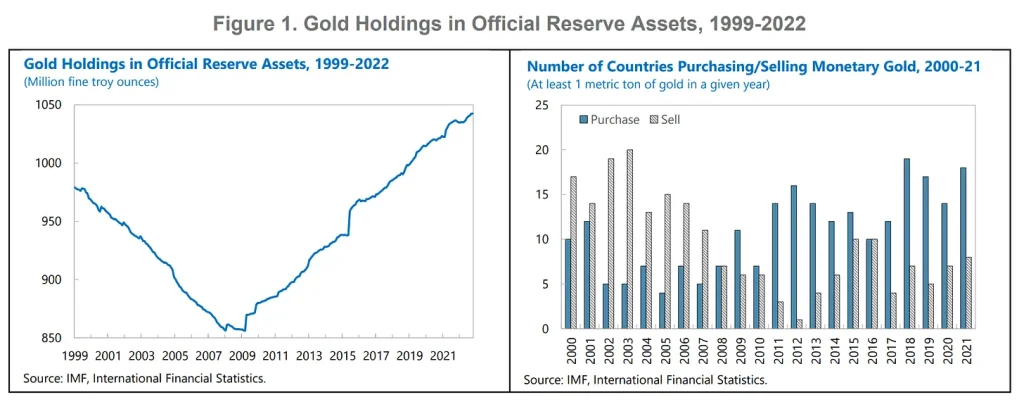

And the whole world is now moving toward gold.They’re afraid to hold dollars. Dollar holdings by foreign central banks have been at just stable, while the gold holdings have been going up.

And many foreign official gold holdings are held off the books. The government will hold stock in a company that holds gold. You can conceal what they’re doing, so they won’t very conspicuously being shown to be dumping the dollar.

There’s a kind of Kabuki dance going on in financial statistics, as well as in dropping bombs on countries.

The Military-Industrial Complex

BEN NORTON: Michael, I want to talk about the military-industrial complex, because another point that you made in this article which is very important and is often left out is how US military contractors profit from these wars — like we saw in what they’re now calling the 12-Day War, between the US/Israel and Iran.

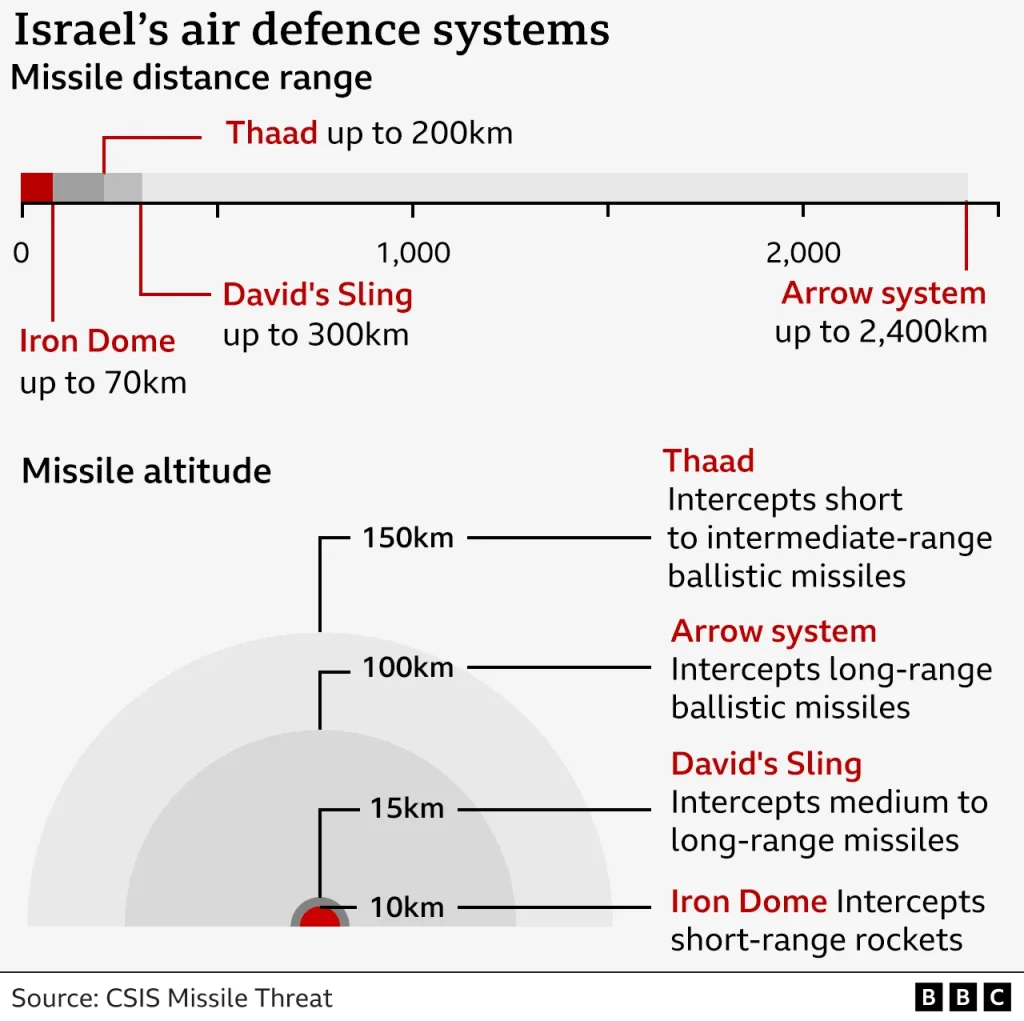

You pointed out that Iran was mostly using its older missiles. It was emptying its stockpile of old missiles to hit Israel, and trying to overwhelm Israel’s air defense system.

Now, we know that US military contractors have boasted about the advanced military equipment the US has given to Israel, like the Iron Dome, the David’s Sling system, and the Arrow system.

US corporations have benefited from helping to design these systems, and from providing the missiles and interceptors.

So Israel has spent many millions of dollars trying to shoot down these old Iranian missiles that Iran wanted to get rid of anyway.

If the war had continued, it would obviously have bled more and more resources of Israel and the US.

But as you point out, this is actually something that the military-industrial complex in the US benefits from, because what the US calls the “aid” that it gives to many countries is actually not really aid; it’s actually contracts given to US private contractors, and then they give that military equipment to Israel, or to Egypt, or to Japan, South Korea, and other countries.

So can you talk more about the role of the military-industrial complex, and how it has profited from all of this?

MICHAEL HUDSON: Well, this is the key to the debate in Congress that is now occurring over the Republican tax law. The enormous amount of money that is spent on the military-industrial complex that basically, the weapons it makes do not work.

We’ve seen in Ukraine the inability of the NATO countries to defend against the Russian missiles.

We’ve seen in Israel that the Iron Dome is very easily penetrated by Iran.

And Iran, already several months ago, demonstrated this when it sent two sets of rockets. It warned Israel, “We don’t want to go to war. We don’t want to hurt anybody, but we just want to show you that we can bomb you whenever you want, and so we’re gonna drop a bomb on this particular location; get everybody out of there; we’re just gonna show you that it works. Try to shoot us down”. And they dropped it.

They did the same with the United States, in Iraq, saying, “You know, we don’t want to really have to go to war with you in Iraq. We lost a million Iranians fighting the Iraqis, when you were setting Saddam Hussein against us before [in the Iran-Iraq War in the 1980s], but you should know that we can wipe out your American bases whenever we want. Let’s give you a demonstration. Here’s a base that’s not very populated. We’re going to bomb it, so get everybody out; we don’t want anyone to get hurt. We’re gonna bomb you on such and such a date. Do everything you can to shoot us down”. Whoosh! They bombed it. America could not shoot them down.

Well, the Iron Dome obviously doesn’t work, nor does the American military defense work.

Well, President Trump has just come out and said, “We’re going to vastly increase the US budget deficit by creating an Iron Dome in the United States for $1 trillion”.

Well, imagine spending a trillion dollars replicating the system that Iran and Russia show that they can penetrate right away.

BEN NORTON: Michael, this is called the Golden Dome. And Elon Musk’s companies like SpaceX are poised to get massive US government contracts. It is estimated that hundreds of billions of dollars in total will be spent to make this Golden Dome that won’t even work.

MICHAEL HUDSON: Of course, for Trump, everything is gold, not iron — I should have noticed that — just like the doorknobs in his Trump Towers, of course.

So we’re seeing this fantasy.

What the military-industrial complex makes aren’t arms to actually be used in war. They’re arms to be traded or sold.

And, as as you pointed out, in addition to the enormous amount of direct Congressional spending on buying arms for the US Army, Navy, and Marines, on the military, the United States gives foreign aid to South Korea, Japan, and other countries, and this foreign aid is spent by their own purchases of US military arms.

This is not included in the American military budget, but in effect, it’s financing the military-industrial complex through the back door, by giving money to America’s allies to buy America’s arms, that also don’t work.

Well, you must wonder what these allies are thinking now, especially in Europe, it’s almost embarrassing to see NATO refusing to acknowledge the fact that the American arms that it wants to buy, and the European arms that it has made, simply are not able to defend themselves against Russian and Iranian arms.

American technology is backwards, because the military-industrial complex companies have taken all this enormous money that they’ve paid, their profits that they’ve made, by paying out dividends and buying their own stocks.

They haven’t spent it on research and development. 92% of every dollar they’ve got is recycled into supporting their stock prices, not in actually making arms.

So, by financializing its military system, along with the industrial economy as a whole, the United States has essentially de-industrialized itself, and you could almost say disarmed itself, against the rest of the world, that actually spends their military money on arms that work, arms that are intended to work, not simply to make profits, to increase the stock prices of military-industrial companies.

BEN NORTON: Yeah, I think that’s actually a great note to end on. We could go on for another hour, but we should save that for another time.

Michael, is there anything you would like to recommend for people who want to find more of your work?

MICHAEL HUDSON: Well, I have my website, Michael-Hudson.com, and all of my articles are on the website, including the one that Ben has just mentioned. So you can see my ongoing commentary on all of this.

And my book Super Imperialism explained the whole unfolding dynamic of all of this.

BEN NORTON: As always, Michael, it’s a real pleasure. Thanks for joining us today, and we’ll talk again soon.

MICHAEL HUDSON: Well, it was a timely discussion.Thanks for having me.

The spell checker you use delivers some funny corrections:

[…] accumulate a rainy day dollar assets horde

Hoard, of course. But the image of a large troop of aggressive dollar assets is quite amusing.

Looks more a transcription software bug.

Well, this typo appears in the introduction, not in Hudson’s interview. So the most probable cause is the spell checker having its own particular idea about which words are correct.

Yeah, those massive and aggressive dollar assets – like China’s reserves.

It’s the New Yellow Peril! The Asiatic Hordes are going to “flood” the market (Sorry for the silliness, but I have to be silly in order not to fall into depression :-)

Read Michael Hudson! No matter how much you think you have a solid grasp of economics, finance and international relations, read Michael Hudson. Start with Superimperialism and you will likely find that what seemed like familiar history – the first half of the 20th Century – needs to be understood differently to account for the rise of American power. Read Michael Hudson and you will relearn how the IMF and World Bank and the rise of the dollar as the world’s reserve currency have cemented the US’ dominant role in the world economy. Read Michael Hudson to fully appreciate what America’s deindustrialization and indebtedness has done to our political life. Read Michael Hudson and you will see that chaos and destruction are not accidents of misguided US policy, but instead are the US policy itself. You can come into Michael Hudson’s work from many different directions, but do the reading! Thanks editors, for posting this piece here, and thanks Ben Norton for continuing to give Michael Hudson a forum to reach people.

Thank you for reposting this excellent overview. It is a useful compliment to the article on which their discussion is based. Ben is very good at asking the right questions and setting the context for Micheal’s key points. Among the most important of those are first, that the current chaos in the Middle East is not the result of a bunch of isolated historical accidents or eruptions of ancient ethnic tensions, but were *planned*. I am SO tired of hearing various versions of the “incompetence” argument, that the US always believes it can foster “democracy” and economic development in country A or B but just doesn’t understand its historical or ethnic or geopolitical “complexities,” blah blah blah. This chaos is part of a long-term plan, and as Michael points out, those with the “vision” have been around for a long time.

Second, there are major economic interests behind this global vision. Their ideas may be deluded and prove disastrous in the long run, but over the years they have supported the “Israel as our unsinkable aircraft carrier” argument. But on this point I would add my own caveat. The Zionists running Israel, and their friends embedded throughout our foreign policy and national security establishment, have their own ideological interests. They are not just clueless dupes being used by “global capital.” They have used and manipulated US policy for their own ends as well. The “Israel lobby” is not just a cover for Wall Street. And just as the various criminal gangs, drug lords, fascist paramilitaries, and jihadists we have utilized in the past have had their own agency and used us as well in ways that have come back to bite us, so, too, do the Israelis. And blowback could really be a bitch in this case. I think it is useful to recognize that the interests of various factions that have converged to shape our policies in the Middle East are not identical and may well lead to some of those “unintended consequences” that the incompetence theorists are always talking about.

I agree, as Michael Hudson shows, the interests are long-term and the policies long-term. There is, however, lots of individual incompetence in the past couple of US regimes. Both the Genocide Joe and DT2 regimes have their share of kakistocrats and idiot sycophants. But that is not what you are referring to.

Andrei Martyanov, in a recent interview, said that the DT displays signs of mental illness. Anything he says should be dismissed as “gibberish”. So this sort of incompetence may well be mental illness.

Re: incompetence, yes, and I wonder how many of the bureaucrats implementing these “strategies” are really just running on mental fumes, kind of like, “Assume we are the rulers of the world forever—now act based on that.” Not to get too “invisible hand” about it, but is there even a strategy anymore in large swathes of the establishment? Or have we devolved from Herman Kahn evil genius types driving things to Ted Cruz type morons with their pudgy fists on the levers of powers?

Mr. James, the entire US government is full of fools, sycophants, and the disturbed. If everything that Dr. Hudson described above is correct, then we have a leadership class who is dedicated to destroying the world rather than sharing it. I’m hard pressed to consider a more insane premise but I can’t find a better explanation for the likes of Vicky Nuland and her husband. Or, our dearly deposed Prince Hunter Biden. They will burn the world and charge the poor for the heat the fire gives.