日志

德国财长在G20推动 对全球金融交易征税

|

International Tax: OECD and G20 BEPS Action Plan Overview

In an effort to curb multinational tax avoidance and offshore tax evasion in developing countries, the Organisation for Economic Co-operation and Development (OECD) and G20 have created the base erosion and profit shifting (BEPS) project and related action plan. Lawyers in Osler’s leading Tax Group are experts on the complexities of international taxation and understand the challenges of a rapidly changing global economy. Here they offer timely insight into global tax reforms, notably the ongoing developments of the OECD/G20 BEPS Action Plan.

As the Action Plan unfolds through 2014 and 2015, Osler will continue to provide reports on the impact of the plan initiatives. Continue to visit this page for useful information.

Plan Overview

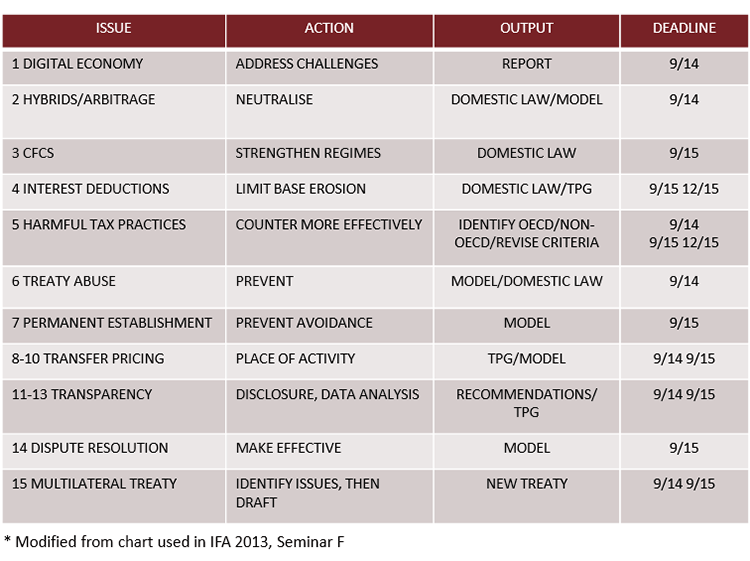

This chart is an overview of the 15 issues that have been identified as part of the OECD/G20 BEPS Action Plan, including deliverables and deadlines (issued September 2014).

Publications

The following Osler Updates highlight specific initiatives the OECD has implemented as they move forward with the BEPS Action Plan.

International Tax Reform 2015-BEPS Final Reports – Oct 6, 2015

On October 5, 2015, the OECD released its final reports relating to the OECD/G20 base erosion and profit shifting (BEPS) initiative. These reports will be presented to the G20 Finance Ministers for approval later this month, and to the G20 Leaders at their annual summit in November. With the finalization of the reports, attention now turns to whether, and to what extent Canada and other countries will implement the various recommendations into tax treaties and domestic law. Their implementation could lead to significant uncertainty and increased international tax disputes. This Update summarizes the final BEPS reports and their potential impact on Canadians.U.S. Treasury Attempts to Influence OECD’S BEPS Initiative via Proposed Changes to U.S. Model Treaty – June 22, 2015 (Author(s): Michael H. Radolinski) The United States has been criticized on more than one occasion for failing to be a meaningful participant in the OECD’s multi-pronged initiative to address base erosion and profit shifting (BEPS). Some commentators have even gone so far as to accuse the United States of actively working against the BEPS project in an attempt to minimize its impact on the United States and U.S. multinationals. Contrary to this perception, however, five draft updates (the Proposed Changes) to the U.S. Model Income Tax Convention (the U.S. Model Treaty) released on May 20, 2015, signal an attempt on the part of Treasury to become more actively involved in (and perhaps even strong-arm) the BEPS conversation.

If adopted, the Proposed Changes would add new provisions to the U.S. Model Treaty that are intended to target the use of U.S. treaties to facilitate “double non-taxation” or “stateless income” and to make U.S. treaties more responsive to changes in treaty partners’ domestic laws that may result in low effective rates of overall taxation. The Proposed Changes also include provisions designed to further discourage so-called “inversion” transactions, in which U.S. companies typically interpose new non-U.S. parent companies and engage in various strategies designed to strip earnings out of the United States or otherwise lower effective rates of U.S. tax.

Treaty Shopping - OECD Releases Revised Discussion Draft on BEPS Action 6 - May 25, 2015

On May 22, 2015, as part of its Action Plan on Base Erosion and Profit Shifting (BEPS), the OECD released for comments a revised discussion draft on “BEPS Action 6: Prevent Treaty Abuse” (the 2015 Treaty Draft).While not final, the proposals and conclusions in the 2015 Treaty Draft appear to indicate what some of the final BEPS recommendations will be regarding changes to tax treaties to prevent treaty shopping and other perceived forms of treaty abuse. If enacted, these changes could significantly restrict access to treaty benefits for many corporations, investors and funds and may lead to a significant increase in international tax disputes. Comments on the 2015 Treaty Draft will be accepted until June 17, 2015.OECD Releases Proposed Changes to Permanent Establishment Rules - May 20, 2015 On May 15, 2015, as part of its Action Plan on Base Erosion and Profit Shifting (BEPS), the OECD released its “Revised Discussion Draft BEPS Action 7: Preventing the Artificial Avoidance of PE Status” (the 2015 PE Draft) for comments. If adopted in tax treaties, the proposals in the 2015 PE Draft could significantly increase the range of circumstances in which business enterprises would see their profits become taxable in foreign jurisdictions. Key changes to the definition of “permanent establishment” (PE) proposed in the 2015 PE Draft include: negotiation of material terms; standard-form contracts; and auxiliary/preparatory exemptions.

- OECD Discussion Draft Considers Controlled Foreign Corporation Rules - Apr 6, 2015

On April 3, 2015, the OECD released a discussion draft on Strengthening Controlled Foreign Corporation (CFC) Rules that stresses the importance of CFC rules in countering base erosion and profit shifting, and makes several draft recommendations regarding the design of domestic CFC rules. The discussion draft expands on the OECD’s prior work as part of its Action Plan on Base Erosion and Profit Shifting (BEPS). - OECD Considers Availability of Tax Treaty Benefits for Investment Funds, Pension Funds and Private Equity Funds - Nov 24, 2014

On November 21, 2014, the OECD released a discussion draft that considers when tax treaty benefits should be granted to various investment funds, including collective investment vehicles, private equity funds, pension funds and sovereign wealth funds. The discussion draft expands on the OECD’s prior work on preventing treaty abuse as part of its Action Plan on Base Erosion and Profit Shifting (BEPS). Canada, together with other G20 countries, has committed to completing work on the BEPS project in 2015. Comments on the latest discussion draft may be provided by January 9, 2015. - OECD Releases 2014 BEPS Deliverables – Sept 16, 2014

On September 16, 2014, the OECD released the first seven of 15 deliverables promised as part of the OECD/G20 base erosion and profit shifting (BEPS) Action Plan. This Update summarizes the principal aspects of this release, including reports on the Digital Economy; Hybrid Mismatch Arrangements; Harmful Tax Practices; Tax Treaty Abuse; Transfer Pricing & Intangibles; Transfer Pricing Documentation and Country-by-Country Reporting; and Developing a Multilateral Instrument. - OECD Releases Discussion Draft on Tax Challenges of the Digital Economy – Mar 25, 2014

On March 24, 2014, the OECD released a discussion draft identifying the major tax challenges raised by the rapidly developing digital economy and summarizing several possible options to address these challenges. - OECD Releases Discussion Drafts on Hybrid Mismatch Arrangements – Mar 20, 2014

On March 19, 2014, the OECD released two draft discussion papers aimed at neutralizing the effects of hybrid mismatch arrangements, as part of its work on base erosion and profit shifting. The first makes recommendations for domestic law changes. The second addresses OECD model treaty considerations. If implemented, these proposals could have a significant impact on common cross-border arrangements that use hybrid instruments or entities. - OECD Proposes Revisions to Tax Treaties to Prevent “Treaty Abuse” – Mar 17, 2014

On March 14, 2014, the OECD released a discussion draft for public consultation on countering tax treaty abuse, pursuant to action item 6 of the G20 and OECD Action Plan on Base Erosion and Profit Shifting. The Discussion Draft addresses similar issues to those referred to in the 2014 Canadian Federal Budget on treaty shopping. OECD/G20 International Tax Reform: Potential Impact on Canadian Companies - July 19, 2013 Earlier today the OECD provided its Action Plan on Base Erosion and Profit Shifting to the G20, which contains 15 specific recommendations for international tax reform. The OECD expects the Action Plan to be largely completed within two years and will invite the participation of G20 countries that are not OECD members. If followed, these recommendations will have a broad impact on international business activities around the world, including with respect to hybrid entities and instruments, anti-deferral rules, deductibility of financing expenses, harmful preferential tax practices, tax treaty abuse, taxation of digital commerce, transfer pricing, aggressive tax planning disclosure, and the collection and use of global tax information. This Update summarizes these recommendations and some of the potential impacts they may have on Canadian companies.